Next-Generation Data Security, Compliance, & AI Platform

Intelligent Data Protection is Here: BigID Next

Discover the first platform to intelligently address data risk and value at the intersection of security, compliance, privacy, and AI. BigID Next delivers a modular and scalable approach with:

- Advanced Data Security: Covering DSPM, DLP, DAM, and beyond.

- Automated Privacy with AI: Simplifying data mapping, regulations, DSRs, and risk management.

- Smart Governance for Data & AI: Featuring intelligent labeling, cleansing, and compliance.

Beyond features, it's about expanded possibilities. Chat with our experts learn more about BigID and see the future.

-1.png)

Recognized as the #1 data security, privacy, and AI data management solution

-1.png?width=152&height=193&name=image%20(23)-1.png)

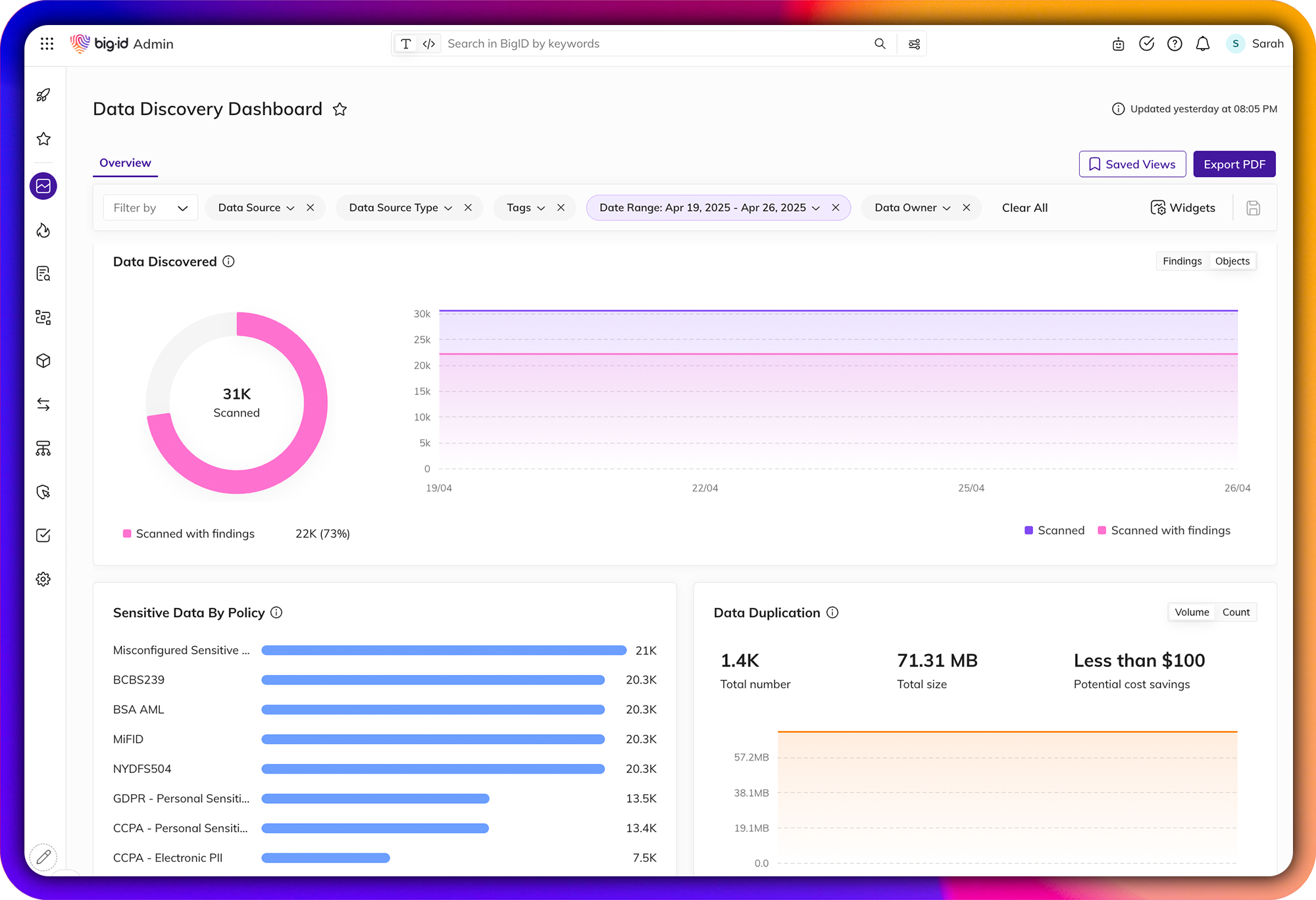

Shine a Light on Dark Data

Automatically find and inventory your most sensitive, critical, and high-priority data - wherever it lives.

Get unmatched data discovery and classification to find and protect the data that matters most to you: whether it's critical, regulated, personal, secrets, passwords, IP, financial, or more across structured and unstructured data. Get more accurate results every time with ML-driven data classification - across your entire data landscape (from on-prem to cloud to everywhere in between).

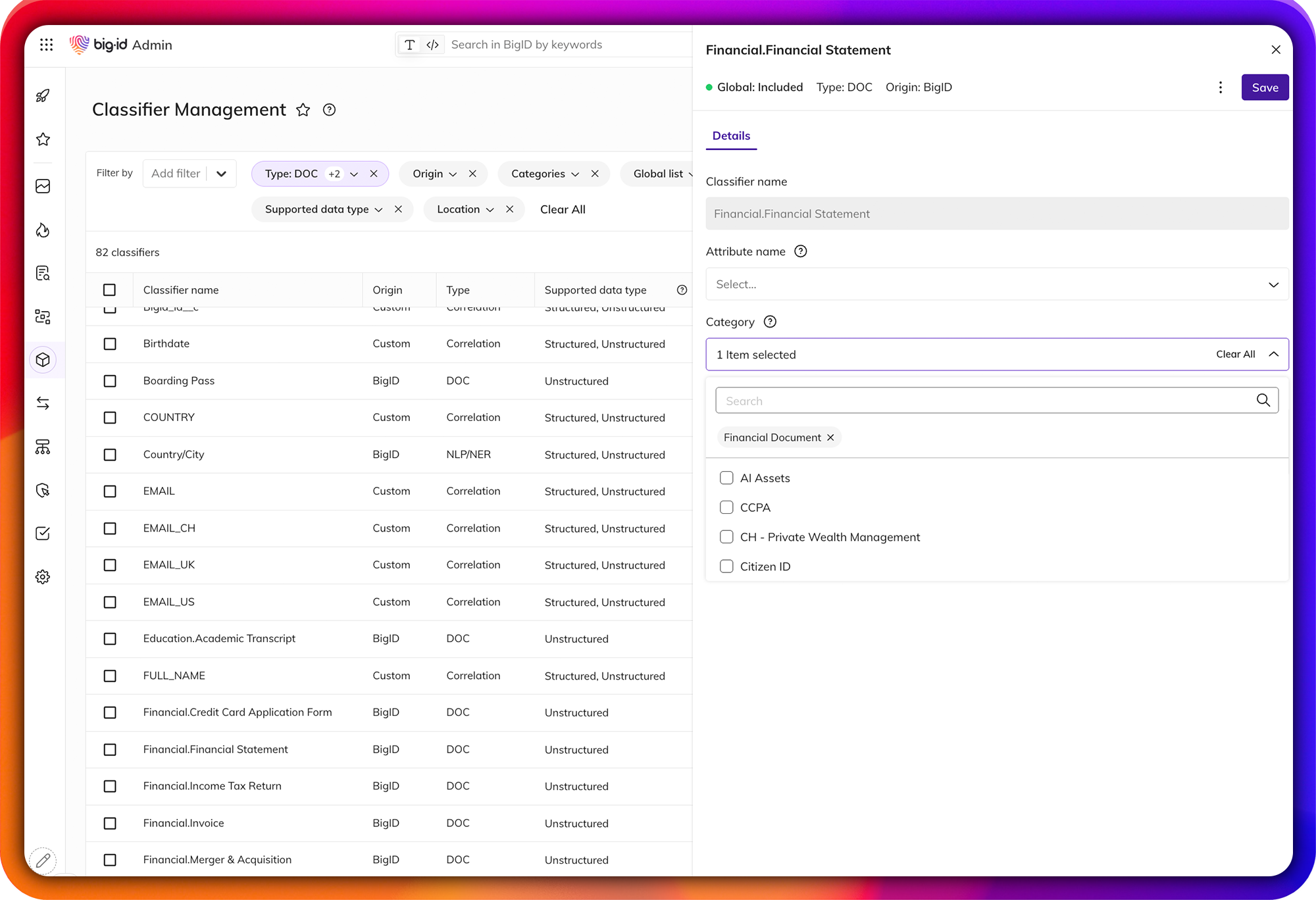

Advanced Sensitivity Classification

Achieve unparalleled accuracy and scalability in data classification.

Go beyond traditional pattern-matching and regular expression (RegEx) with advanced, trainable ML and NLP-based classification. Create custom classifiers that can be tailored specifically to your unique data environment. Test and fine-tune them before deployment to enhance accuracy and mitigate the number of false positives. Label and tag all of your data using a single unified classification ruleset.

Data-Centric, Risk-Aware Security for AI in the Multi-Cloud & Beyond

Get ahead of AI security challenges with a data-first approach.

BigID helps you proactively identify sensitive, toxic, and high-risk data fueling AI models, so you can reduce exposure, ensure compliance, and minimize risk. Whether it's PII, IP, or shadow AI, BigID gives security teams the visibility and control they need across multi-cloud and on-prem environments, from training data to AI pipelines.

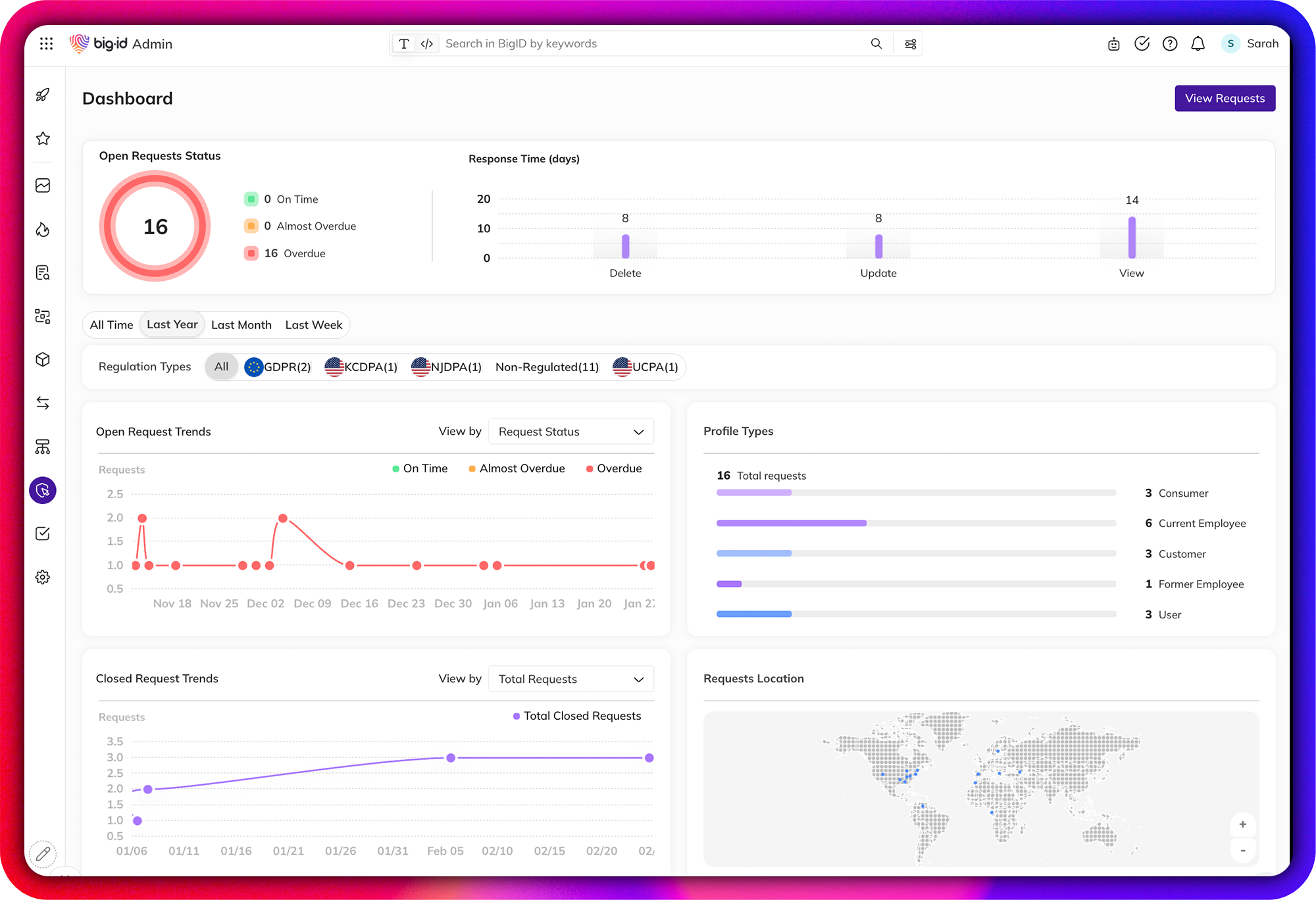

Data Rights Automation

Automate data rights fulfillment from access to deletion.

BigID automates DSR intake, verification, and fulfillment—whether it’s access, deletion, rectification, or portability—across structured and unstructured data. Reduce manual effort, accelerate response times, and stay compliant with GDPR, CPRA, LGPD, and other global regulations.

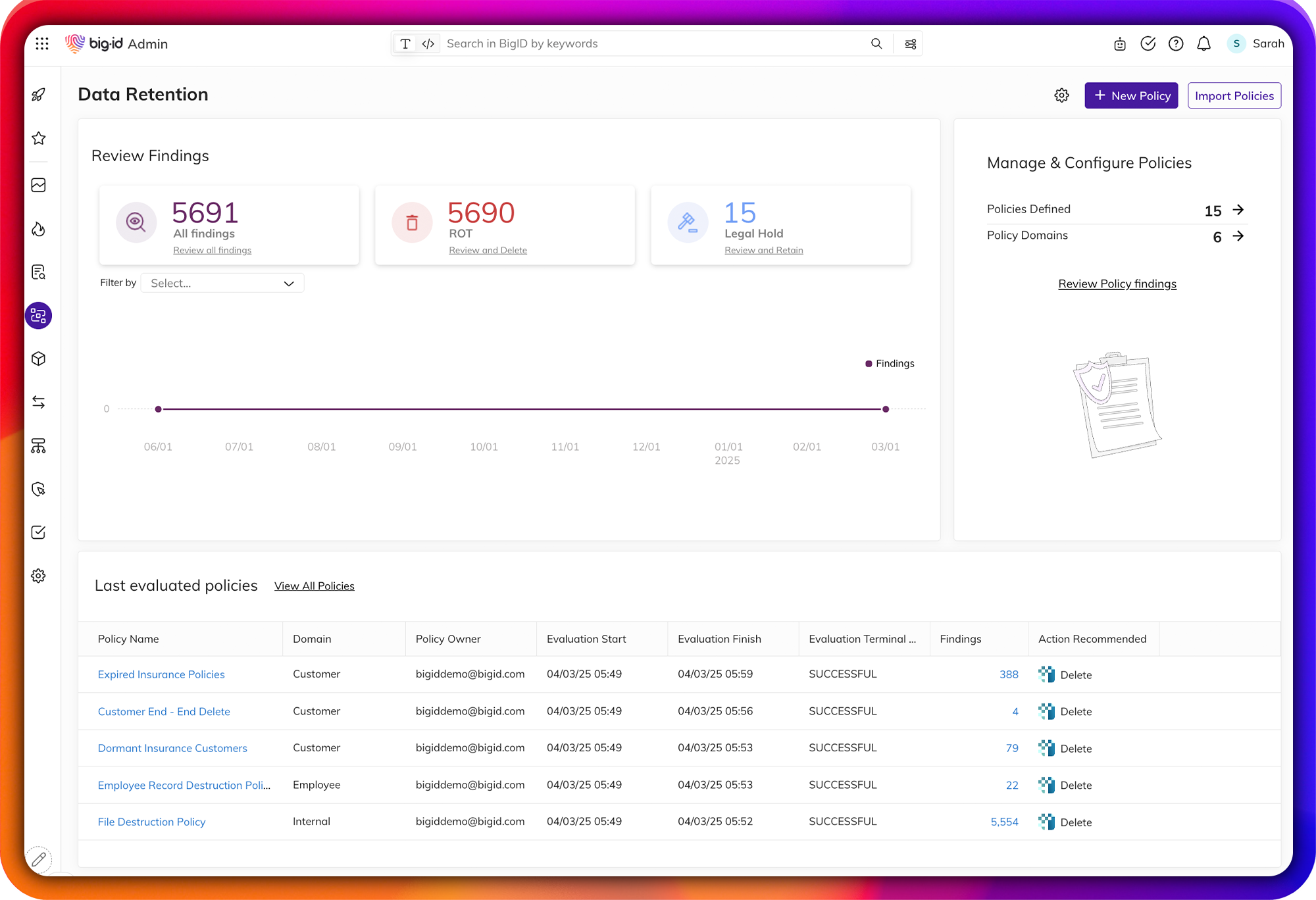

Data Retention

Reduce data risk with policy-driven retention management for all data, everywhere.

Set retention policies and identify what data to delete, when to delete it, and what data to retain. Automate policy management to identify data, apply policies, take action, and audit for compliance.

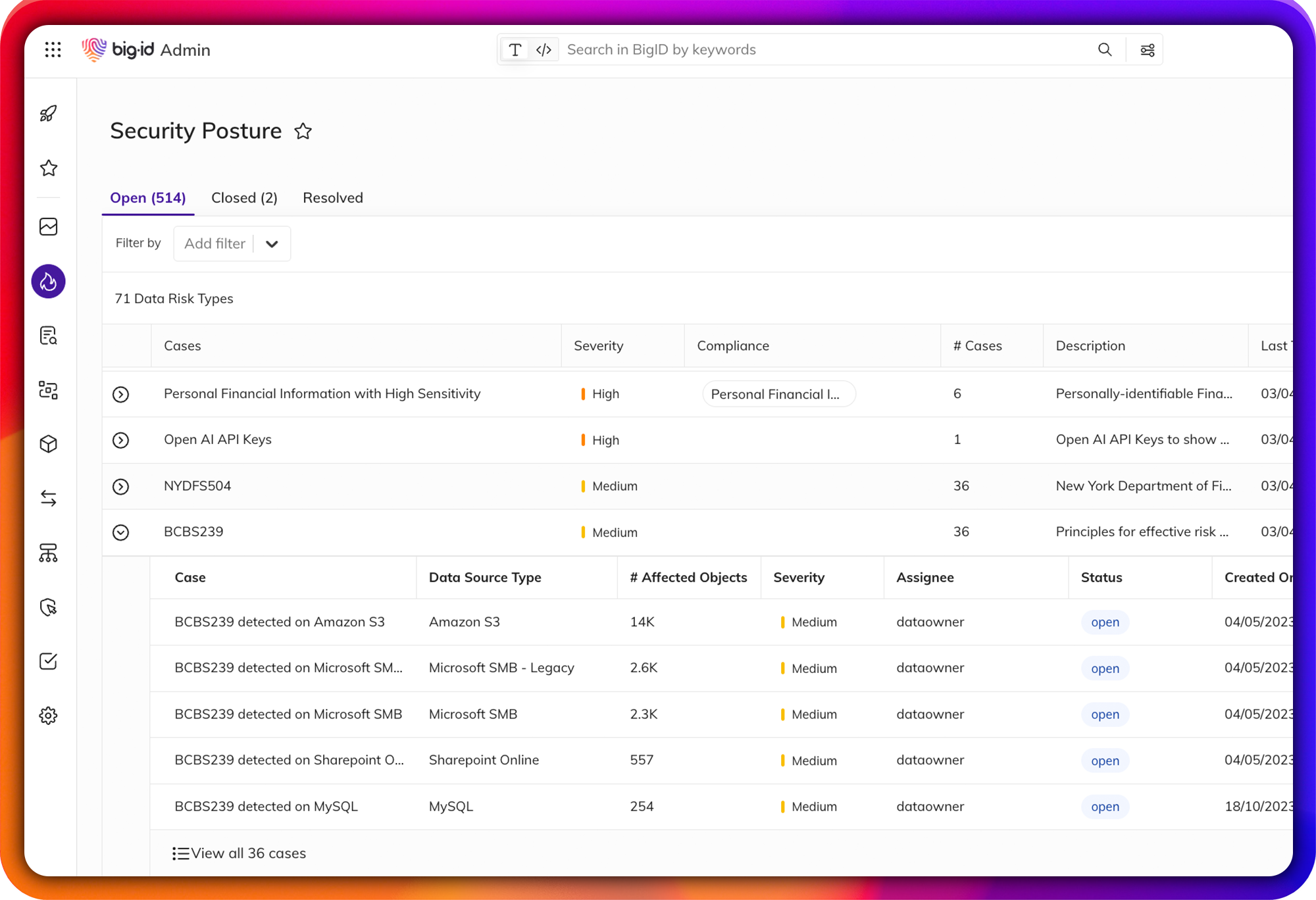

Streamline Data Protection Workflows & Remediate Risk

Remediate high-risk, sensitive, & critical data, everywhere.

Make it easier than ever for the right people to take the right actions, on the right data. Manage data protection all in one place - a single pane of glass to annotate, delete, quarantine, archive, mask, encrypt, and anonymize sensitive data.

Assign findings and tasks to the right data owners, take action on the right data, and maintain an audit trail of all data protection activity. Enforce and prioritize your remediation actions by policy and report on actions taken on sensitive data.

.png?width=2000&height=1368&name=ai-remediation%20(1).png)

2025 RESEARCH REPORT

AI Risk & Readiness in the Enterprise

AI is revolutionizing the enterprise — but governance hasn’t caught up and the risk gap is widening.

Based on insights from hundreds of security, compliance, and data leaders, this exclusive research report breaks down the current state of AI governance, outlines key risks, explores AI regulation and compliance, details pain points by industry, and provides actionable takeaways for your organization.

How the US Army Ensures

Their Data is in the Safe Zone

BigID has equipped the US Army with the ability to illuminate dark data, accelerate cloud migration, minimize redundancy, and automate data retention. The result? Enhanced security, minimized risks, and streamlined data management across diverse platforms. See how BigID can help do the same for your organization.

How The University of Maryland Saved $5 Million in Risk Exposure

The University of Maryland used BigID to uncover and reduce over $5M in data risk across 2.5PB of cloud storage. With deep discovery and classification across Google Drive, O365, and Box, they identified and cleaned up thousands of exposed PII records—boosting compliance, minimizing exposure, and improving visibility across their data.

.png)